Содержание

- Cryptocurrency: The 10 Best Cryptos To Mine In 2022 That Are Not Bitcoin

- What Is Cryptocurrency?

- Advantages And Disadvantages Of Cryptocurrency

- Bitcoin Vs Ethereum: Whats The Difference?

- Pros And Cons Of Investing In Cryptocurrency

- Types Of Cryptocurrency

- Why Do Bitcoins Have Value?

- Definition And Example Of Cryptocurrency

Cryptocurrencies are digital or virtual currencies underpinned by cryptographic systems. They enable secure online payments without the use of third-party intermediaries. “Crypto” refers to the various encryption algorithms and cryptographic techniques that safeguard these entries, such as elliptical curve encryption, public-private key pairs, and hashing functions. The process incentivizes the miners who run the network with the cryptocurrency.

- In the rest of the world, cryptocurrency regulation varies by jurisdiction.

- The remittance economy is testing one of cryptocurrency’s most prominent use cases.

- They leave a digital trail that agencies such as the Federal Bureau of Investigation can decipher.

- One of the conceits of cryptocurrencies is that anyone can mine them using a computer with an Internet connection.

Therefore, it has been difficult to make a case for their legal status in different financial jurisdictions throughout the world. It doesn’t help matters that cryptocurrencies have largely functioned outside most existing financial infrastructure. The legal status of cryptocurrencies has implications for their use in daily transactions and trading. In June 2019, the Financial Action Task Force recommended that wire transfers of cryptocurrencies should be subject to the requirements of its Travel Rule, which requires AML compliance. The advantages of cryptocurrencies include cheaper and faster money transfers and decentralized systems that do not collapse at a single point of failure. Grin is a community-driven cryptocurrency that is completely open-source.

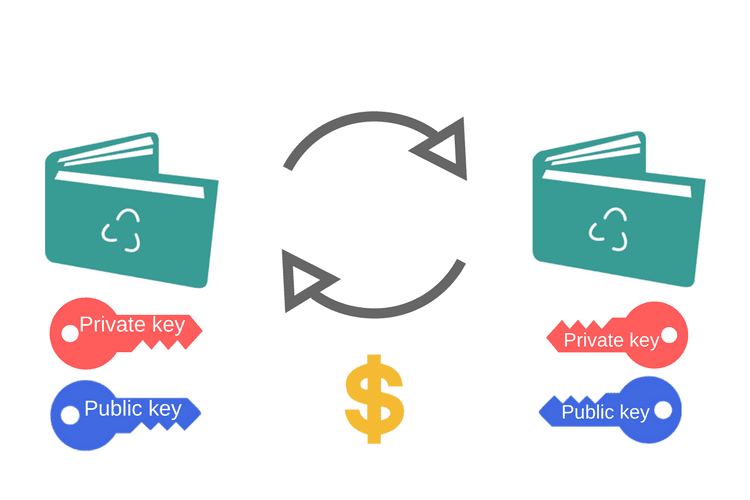

For instance, if Sam decides to send one Ethereum to Nina, 1ETH is taken from Sam’s wallet and added to Nina’s. The transaction would be a piece of code that would include data such as the recipient’s address, the sender’s signature, and the value of crypto to be moved, among other things. Once it’s done, this move would be broadcast on the Ethereum network to be verified ormined. There are more than 13,000 cryptocurrencies, with a global market value of over $2.73 trillion being traded on 425 exchanges, according to CoinMarketCap.

Cryptocurrency: The 10 Best Cryptos To Mine In 2022 That Are Not Bitcoin

Cryptocurrencies are not backed by governments and are not legal tender. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. Some economists thus consider cryptocurrencies to be a short-lived fad or speculative bubble. Fiat currencies derive their authority as mediums of transaction from the government or monetary authorities.

Ethereum, XRP, and Litecoin are among some of the best-known cryptocurrencies. Cryptocurrencies have become a popular tool with criminals for nefarious activities such as money laundering and illicit purchases. The case of Dread Pirate Roberts, who ran a marketplace to sell drugs on the dark web, is already well known. Cryptocurrencies have also become a favorite of hackers who use them for ransomware activities. Some advantages and disadvantages of cryptocurrencies are as follows.

The expensive energy costs coupled with the unpredictability of mining have concentrated mining among large firms whose revenues running into the billions of dollars. According to an MIT study, 10% of miners account for 90% of its mining capacity. Though they claim to be an anonymous form of transaction, cryptocurrencies are actually pseudonymous. They leave a digital trail that agencies such as the Federal Bureau of Investigation can decipher. This opens up possibilities of governments or federal authorities tracking the financial transactions of ordinary citizens. As of December 2021, El Salvador was the only country in the world to allow Bitcoin as legal tender for monetary transactions.

Any investor can purchase cryptocurrency from popular crypto exchanges such as Coinbase, apps such as Cash App, or through brokers. Another popular way to invest in cryptocurrencies is through financial derivatives, such as CME’s Bitcoin futures, or through other instruments, such as Bitcoin trusts and Bitcoin ETFs. Although cryptocurrencies are considered a form of money, the Internal Revenue Service treats them as a financial asset or property. And, as with most other investments, if you reap capital gains in selling or trading cryptocurrencies, the government wants a piece of the profits. Department of the Treasury announced a proposal that would require taxpayers to report any cryptocurrency transaction of and above $10,000 to the IRS. But cryptocurrencies are not backed by any public or private entities.

You can trade cryptocurrencies for one another or fiat currencies, such as the U.S. dollar. A blockchain is a digitally distributed, decentralized, public ledger that exists across a network. The process involves downloading software that contains a partial or full history of transactions that have occurred in its network. Though anyone with a computer and an Internet connection can mine cryptocurrency, the energy- and resource-intensive nature of mining means that large firms dominate the industry.

What Is Cryptocurrency?

There is growing adoption of crypto for transactions, with many financial services providers accepting them. You need as little as $1 to buy cryptocurrency, and you can spend it using cryptocurrency credit or debit cards. However, you should be aware of how taxes work when you spend your cryptocurrency. If your bitcoin has increased in value since you acquired it, the increase in value is considered to be taxable income or capital gains, depending on the circumstances.

As of Dec. 20, 2021, Bitcoin was valued at more than $862 billion in crypto markets. AE uses CuccooCycle hashing to combine Proof-of-Work and Proof-of-Stake algorithms, allowing miners to create blocks while also verifying transactions. Using a mining calculator to calculate the profitability of your future mining operation is a good idea. To see how much profit you could make per day, enter the cryptocurrency you want to mine, your hardware, hashing power, and so on. Visa and PayPal also provide options for making cryptocurrency transactions.

DigiByte, which is based on UTXO technology, processes network transactions using five different independent algorithms. This technology supports a variety of mining options, including ASIC, GPU, and CPU, allowing DGB mining to be as profitable as possible. Cryptocurrencies are lines of digitally signed code where transactions are verified by computers on a blockchain. Some may think of cryptocurrency as an “alternative” investment, lumped in with precious metals, private equity, collectibles, and any other investment that is not traded on stock exchanges. After some hiccups with the adoption of cryptocurrencies, they are now being accepted by a growing number of financial service providers.

Bitcoin is the best-known cryptocurrency and the first industrial-strength version of the blockchain implementation. It was first introduced in 2009 through a white paper authored by Satoshi Nakamoto. Central Bank Digital Currency is the digital form of a country’s fiat currency, which is regulated by its central bank. Cryptocurrencies were introduced with the intent to revolutionize financial infrastructure. At the current stage of development for cryptocurrencies, there are many differences between the theoretical ideal of a decentralized system with cryptocurrencies and its practical implementation. Within the United States, the biggest and most sophisticated financial market in the world, crypto derivatives such as Bitcoin futures are available on the Chicago Mercantile Exchange.

Advantages And Disadvantages Of Cryptocurrency

All Crypto Wallet transactions have a unique cryptographic signature, which creates a fixed record on the blockchain. Bitcoin, which was made available to the public in 2009, remains the most widely traded and covered cryptocurrency. As of November 2021, there were over 18.8 million bitcoins in circulation with a total market cap of around $1.2 trillion.

Each https://xcritical.com/ claims to have a different function and specification. For example, Ethereum’s ether markets itself as gas for the underlying smart contract platform. Ripple’s XRP is used by banks to facilitate transfers between different geographies.

A cryptocurrency is an encrypted data string that denotes a unit of currency. It is monitored and organized by a peer-to-peer network called a blockchain, which also serves as a secure ledger of transactions, e.g., buying, selling, and transferring. Unlike physical money, cryptocurrencies are decentralized, which means they are not issued by governments or other financial institutions. A cryptocurrency is a digital or virtual currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend.

Bitcoin Vs Ethereum: Whats The Difference?

Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Central to the appeal and functionality of Bitcoin and other cryptocurrencies is blockchain technology. As its name indicates, blockchain is essentially a set of connected blocks or an online ledger. Each block contains a set of transactions that have been independently verified by each member of the network.

A block of 60 grins is mined every minute, producing one coin every second, indefinitely. With a fixed block mining reward, such linear emission creates a constant increase in supply while lowering the rate of inflation. This design not only ensures the blockchain’s long-term security, but also makes the mining process more equitable and democratic. The Lyra2REv3 proof-of-work hashing algorithm is used to create Vertcoin. This cryptocurrency is resistant to ASIC mining, which means it can only be mined using a GPU or CPU. To promote decentralization, Vertcoin’s creators made the coin ASIC-resistant.

Cryptocurrencies traded in public markets suffer from price volatility. Bitcoin has experienced rapid surges and crashes in its value, climbing to as high as $17,738 in December 2017 before dropping to $7,575 in the following months. One of the conceits of cryptocurrencies is that anyone can mine them using a computer with an Internet connection. However, mining popular cryptocurrencies requires considerable energy, sometimes as much energy as entire countries consume.

A cryptocurrency is a form of digital asset based on a network that is distributed across a large number of computers. This decentralized structure allows them to exist outside the control of governments and central authorities. It is one of the best cryptocurrencies to mine with GPU miners thanks to its Lyra2RE proof-of-work hashing algorithm. All that is required is a secure hardware wallet and a hardware device capable of mining the coin.

Pros And Cons Of Investing In Cryptocurrency

When it comes to choosing which cryptocurrency to mine, many people choose the second most popular cryptocurrency and the original smart contracts launchpad. It is vital to understand that cryptocurrency laws are still being formed. Once the block is validated or mined, it gets added to the blockchain. The miner, or the computer, that does this gets paid for its effort.

Types Of Cryptocurrency

Many versions of cryptocurrencies came and went over the years without much notice until Bitcoin came along in 2009. Cryptocurrency may not be right for many investors, due to its high-risk nature. While you may be able to make money quickly from it, prices are also highly volatile.

Why Do Bitcoins Have Value?

Every new block generated must be verified by each node before being confirmed, making it almost impossible to forge transaction histories. The public key is used to create an address for your wallet so you can receive cryptocurrencies. A private key, combined with the wallet, gives you the cryptographic signature that helps verify cryptocurrency transactions. Though cryptocurrency blockchains are highly secure, other crypto repositories, such as exchanges and wallets, can be hacked. Many cryptocurrency exchanges and wallets have been hacked over the years, sometimes resulting in millions of dollars worth of “coins” stolen. Cryptocurrencies promise to make it easier to transfer funds directly between two parties, without the need for a trusted third party like a bank or a credit card company.

A simple cryptocurrency transaction involves sending it from one person to the next. Cryptocurrencies are stored in virtual “wallets,” and the transfer occurs from one wallet to the next. It is named after Satoshi Nakamoto, the creator of the protocol used in blockchains and the bitcoin cryptocurrency. Ethereum is a blockchain-based software platform with the native coin ether. Ethereum smart contracts support a variety of distributed apps across the crypto ecosystem.

Such decentralized transfers are secured by the use of public keys and private keys and different forms of incentive systems, such as proof of work or proof of stake. In this system, centralized intermediaries, such as banks and monetary institutions, are not necessary to enforce trust and police transactions between two parties. Their promise is to streamline existing financial architecture to make it faster and cheaper.